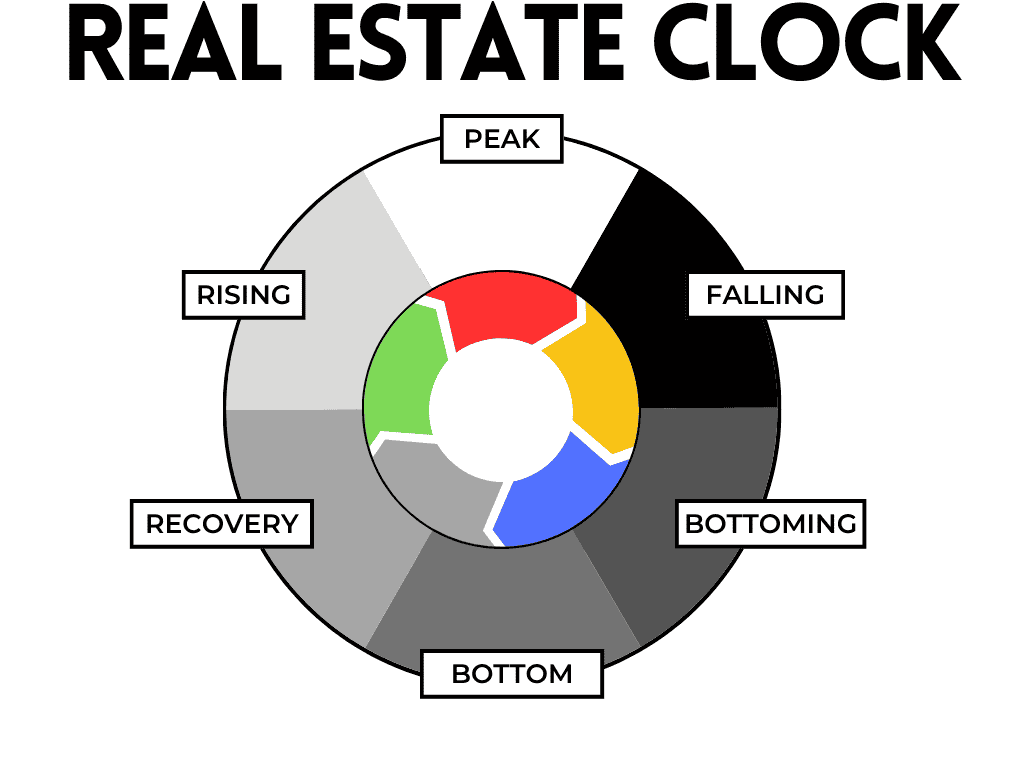

The real estate market operates in cycles that can generally be categorized into six phases: rising, peak, falling, bottoming, bottom and recovery.

During a rising phase, property values and demand increase, leading to higher prices and market activity.

At the peak, the market reaches its maximum growth and may become overheated. This is when capital is flowing, and deal activity is off the charts (2020-2022.)

This is followed by a falling phase, where prices stabilize or decrease, and demand begins to wane. This is where we are now according to IRR Reports. Miami has been resilient in this respect so far due to the continued flow of both people and capital from formers great cities like New York, Chicago, and San Francisco coming to South Florida.

And is further evidenced anecdotally by watching stores, offices, and restaurants starting to close, and residential rental rates slow down their yearly increases.

Once the falling phase completes, the market begins to slow its contraction, prices are leveling off at the low end and investors are finding value in again balancing cap rates and interest rates.

Finally, we reach the bottom, where values are low, and there is minimal activity.

Usually it takes a few years from the peak to find the “bottom” of the cycle before prices start to rise again. 2008 saw the last cycle top, and we didn’t bottom until 2012.

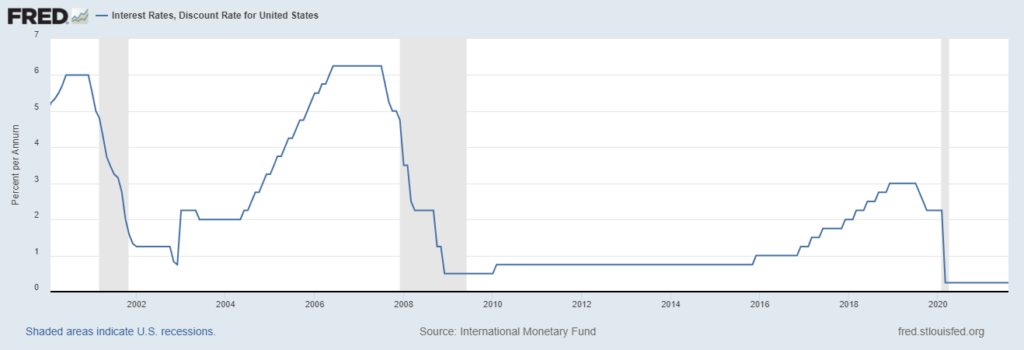

The recovery comes either when prices drop low enough that cap rates vs. interest rates become attractive, or the Federal Reserve pumps the market by dropping interest rates quickly as in 2001, 2008, and 2020.

The 2020 the COVID-19 panic was an outlier event where the stock market dropped like a stone. The Federal Reserve reacted so dramatically, with a firehouse of cheap credit, that the real estate market, instead of crashing as predicted, actually did the opposite and continued it 10+ year advance. The cycle also closely tracks the Fed Reserve interest rates, as activity and values are based on the availability and cost of credit.

Only now, that the Federal Reserve has raised interest rates and kept them over 4% for more than a year, have cap rates and sales prices, have finally begun adjusting to the reality that the Fed is unlikely to drop rates again without reigniting another crushing round of inflation.

Understanding these market cycles is crucial for investors, developers, and owners to make informed decisions and navigate the real estate market effectively.

Whether your next move is to buy, sell, hold or trade, you should always consider where we are in the current cycle before making any decision.

For a data driven perspective on the market, contact me or my office today.