Before you even begin touring potential spaces, having a well-prepared pitch deck or presentation about your business can dramatically improve your leverage with landlords and brokers, especially if you’re a startup without an established digital footprint. These don’t need to be long or overly detailed but should include key points about the team and concept.

Landlords need to know who you are and why they’d want to start a 3+ year relationship with you.

Why Landlords Are Hesitant With New Businesses:

- Commercial leases represent significant financial commitments ($100,000+ over typical lease terms)

- Tenant improvements and broker commissions cost landlords substantial upfront money

- Space vacancy after a failed business means months of lost income

- New businesses statistically have higher failure rates in the first 3 years

What Your Real Estate Pitch Deck Should Include:

- Business Overview: Clear explanation of your products/services and revenue model

- Leadership Team: Backgrounds and experience that demonstrate business acumen

- Financial Information: Current backing, revenue projections, and capital reserves

- Business Plan Summary: Growth strategy and timeline for expansion

- Past Successes: Previous business history or relevant industry experience

- References: Banking relationships, investors, or business partners who can vouch for you

How This Preparation Strengthens Your Position:

- Demonstrates Professionalism: Shows you’re organized and serious about your venture

- Shifts the Power Dynamic: Positions you as a desirable tenant rather than a supplicant

- Answers Key Questions Proactively: Addresses landlord concerns before they become objections

- Creates Confidence: Helps landlords and brokers visualize your success in their property

- Speeds Up Negotiations: Reduces back-and-forth information requests during the process

Special Considerations for Startups Without Online Presence:

Without websites or social media profiles that landlords can research, your pitch deck becomes your primary business credential. It needs to be especially comprehensive, visually professional, and backed by solid financial details. Consider including:

- Detailed explanation of why you’re starting this business

- Market research demonstrating demand for your offering

- Letters of intent from potential customers or partners

- Personal financial statements if business financials are limited

- Specific milestones and metrics you plan to achieve

Pro Tip: Many commercial landlords will run credit checks on both your business and you personally. Being transparent about any potential issues and explaining your mitigation plans in advance can prevent deal-breaking surprises later.

When a landlord is choosing between multiple prospective tenants, the business that appears most prepared, professional, and financially viable will always have an advantage in negotiating favorable terms. Your pitch deck is often your first

Leasing 101: Essential Terms

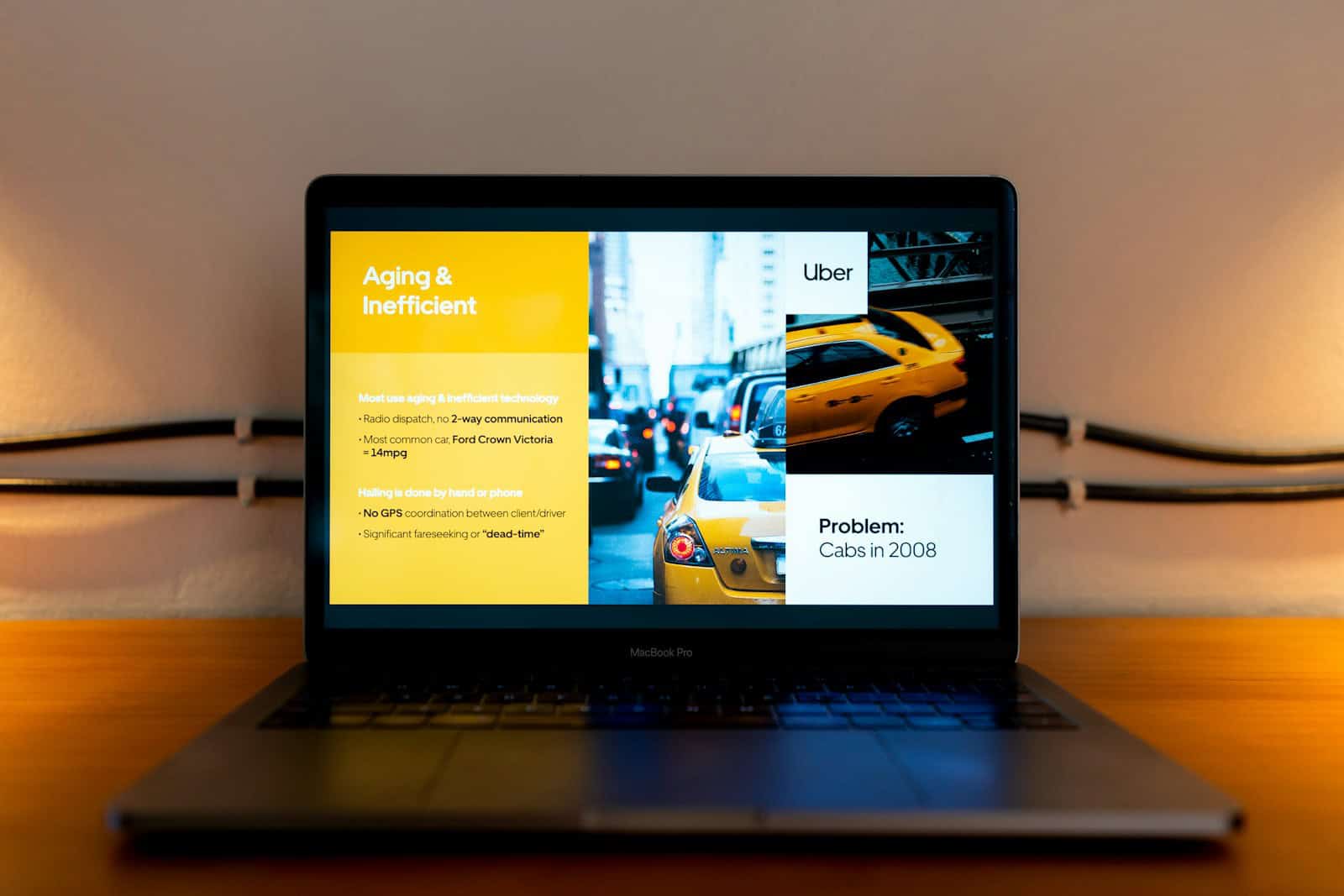

Leasing 102: The Pitch Deck

Leasing 103: Letters of Intent

Leasing 104: What To Expect From Landlords

Leasing 105: From Lease Signing to Renewal