When it comes to commercial real estate, property owners and investors have two main options for generating income from their properties – leasing or selling. While both involve transactions with the property, the goals and strategies behind leasing and selling differ significantly. 1 3 In this blog post, we’ll explore the distinct goals associated with each approach to commercial real estate.

Goals of Leasing Commercial Property

- Generating Consistent Rental Income The primary goal of leasing a commercial property is to generate a steady stream of rental income over an extended period. 3 By leasing out spaces like office buildings, retail stores, warehouses, or industrial facilities to tenants, property owners can earn a reliable monthly or annual revenue. This rental income serves as the backbone of their investment strategy, providing a consistent cash flow to cover expenses, pay off mortgages, and potentially generate profits.

- Maximizing Occupancy Rates Another key goal of leasing commercial real estate is to maintain high occupancy rates across the property portfolio. 1 Vacant spaces not only result in lost rental income but can also lead to higher maintenance costs and a less desirable property image. Successful leasing agents and property managers strive to minimize vacancies by actively marketing available spaces, offering competitive rental rates, and providing attractive amenities to prospective tenants.

- Building Long-Term Relationships For property owners and leasing agents, building strong, long-term relationships with tenants is crucial. 3 Retaining existing tenants through lease renewals is often more cost-effective than constantly seeking new tenants. By fostering positive tenant relationships, addressing their needs, and providing excellent service, property owners can increase tenant satisfaction and loyalty, leading to higher retention rates and a more stable income stream.

Goals of Selling Commercial Property

- Maximizing Sale Price and Profits The primary goal when selling a commercial property is to maximize the sale price and generate the highest possible profits from the transaction. 1 Property owners and investors will typically aim to sell their properties at a price that not only covers their initial investment and associated costs but also provides a substantial return on their investment.

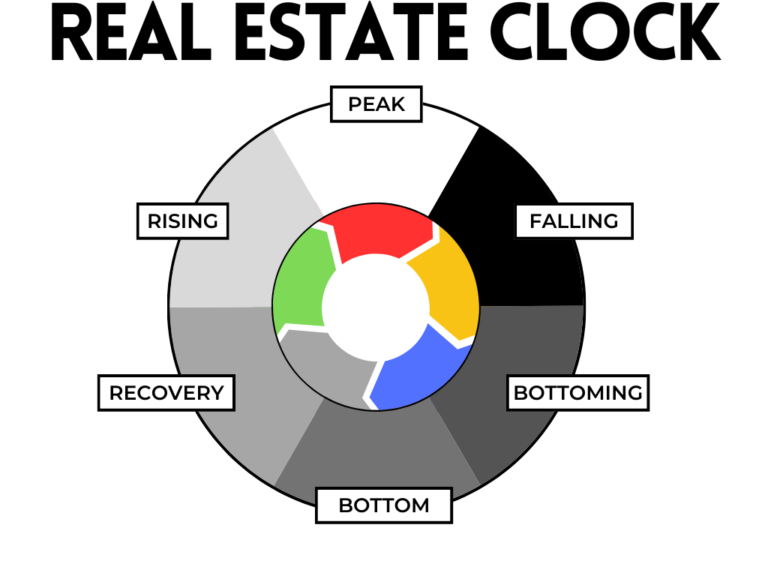

- Realizing Capital Gains Selling a commercial property can be an effective strategy for realizing capital gains, especially if the property has appreciated significantly in value over time. 1 By timing the sale strategically and capitalizing on favorable market conditions, property owners can unlock the equity tied up in their real estate assets and potentially reinvest the proceeds into new opportunities.

- Portfolio Diversification and Risk Management For investors with a diverse portfolio of commercial properties, selling certain assets can be a way to rebalance their holdings, diversify their investments, and manage risk. 1 By selling properties in specific markets or asset classes, investors can reallocate capital to other sectors or regions, reducing their exposure to potential downturns in any one area.

Balancing Short-Term and Long-Term Goals

While leasing and selling commercial real estate have distinct goals, property owners and investors often need to balance short-term and long-term objectives. 3 Leasing can provide immediate and consistent cash flow, but selling may be necessary to realize significant profits or shift investment strategies.

Successful real estate professionals carefully evaluate market conditions, property performance, and their overall investment goals to determine the optimal approach for each asset in their portfolio.

TLDR

The goals of leasing and selling commercial real estate differ significantly. Leasing focuses on generating consistent rental income, maximizing occupancy rates, and building long-term tenant relationships. 3 Selling, on the other hand, aims to maximize sale prices, realize capital gains (or not through a 1031 exchange), and facilitate portfolio diversification and risk management. 1 By understanding these distinct objectives, property owners and investors can make informed decisions that align with their overall investment strategies and financial goals.