Every property, especially commercial property, is unique and a combination of experience, access to good data, and knowledge of how to apply that data is crucial in valuing a property for sale in any given market. Valuing commercial real estate involves a thorough analysis of several critical factors, including location, property condition, and prevailing market trends. Professionals in the field employ a variety of methods to achieve accurate assessments.

Factors Influencing Commercial Real Estate Valuation

Location is a primary determinant of a property’s value. The desirability of an area, its accessibility, and proximity to essential services and infrastructure all play a significant role. Market trends and broader economic conditions are also crucial, as they can significantly influence property values over time. The condition of the property, including its age, maintenance level, and any renovations, is equally important. For investment sales, the prime factor is the income potential of the property, based on its current use and future prospects. Zoning laws and plans for future development in the vicinity can also impact valuations, as they may affect the property’s usability and appeal.

Methods Used for Commercial Real Estate Valuation

There are several methods used to value commercial real estate, each offering unique insights. The Income Approach focuses on the potential earnings a property can generate, making it particularly useful for investment properties. The Sales Comparison Approach examines recent sales of comparable properties to establish a market value, providing a straightforward and relatable assessment. The Cost Approach calculates the replacement cost of the property, minus depreciation, which is useful for new or unique properties. Each method contributes to a comprehensive understanding of the property’s value, helping to ensure accuracy and reliability in valuations. The first two being used primarily during transaction and the third more for Cost Segregation or tax valuations.

Importance of Accurate Valuation in Commercial Real Estate

Accurate valuation is paramount in commercial real estate, as it influences a wide range of financial decisions. It is essential for securing financing, as lenders require reliable assessments to mitigate risk. Starting with clear and attractive pricing attracts potential buyers or tenants by offering transparency and trust, leading to profitable transactions. Investors rely on accurate valuations to make informed decisions, balancing expected returns against potential risks to maximize their investments.

Transparency is a key benefit of accurate valuations. When potential buyers or tenants see that a property is fairly valued, they are more likely to trust the process and move forward with transactions. This trust accelerates decision-making, making the buying or leasing process smoother and faster. An accurately valued property also stands out in the market, drawing attention from serious buyers or tenants who are looking for fair deals.

Challenges Faced in Commercial Real Estate Valuation

Valuing commercial real estate is not without its challenges. Market volatility can lead to rapid fluctuations in property values, requiring brokers to stay informed and adaptable. Complex properties, with unique features or uses, demand detailed analysis and a deep understanding of various factors. Despite these hurdles, knowledgeable brokers can navigate these challenges effectively, using their expertise and available resources to ensure precise valuations.

Market conditions can shift quickly, impacting property values in unpredictable ways. Experienced brokers need to stay abreast of these changes and adjust their strategies accordingly. This agility is crucial for maintaining accurate valuations, even in volatile markets. By being proactive and well-informed, brokers can mitigate the effects of market fluctuations and provide reliable assessments. Evaluating complex properties can be daunting, we excel by leveraging their expertise and advanced tools. We stay up-to-date with market trends and use sophisticated analytical methods to ensure precise valuations. Confidence and experience are key in handling the intricacies of complex properties, leading to more accurate and dependable assessments.

Case Studies in Commercial Real Estate

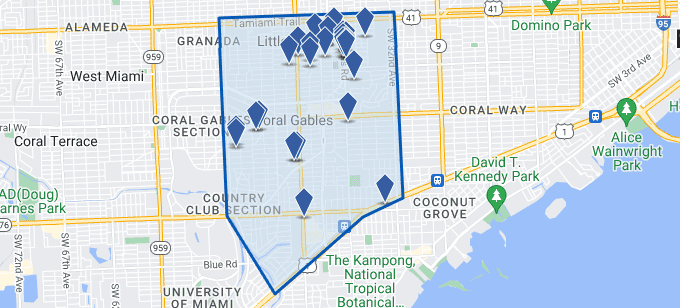

- From Leasing Challenge to Multi-Million Dollar Sale: A Ground Lease Success Story in Brickell

- Finding the Perfect Home for a Growing Homeschool: A MiMo District Success Story

- Turning Challenges into Opportunities: A Tale of Two Tenants in Edgewater

- Case Study: 6105 NW 7th Ave

- Case Study: 5725 SW 77 Ter

TLDR

The market data, trends, experience, and knowledge of how to apply them need to accurately value a property can be difficult and expensive to access, and is learned over years of working in the field. A broker’s commission is their compensation for maintaining this data and knowing how to apply it to price and market a commercial property successfully in any market. If you are looking to maximize the value of your property at a sale, consult a broker.

“Set and enforce an aspirational hourly rate. If fixing a problem will save less than your hourly rate, ignore it. If outsourcing a task will cost less than your hourly rate, outsource it.”

Naval Ravikant