Problem: Large Capital Gains Taxes Makes Sale Less Desirable Than Current Income

Solution: 1031 Exchange

Are you avoiding selling into the longest real estate boom cycle in 80+ years, just because you don’t want to pay the capital gains taxes?

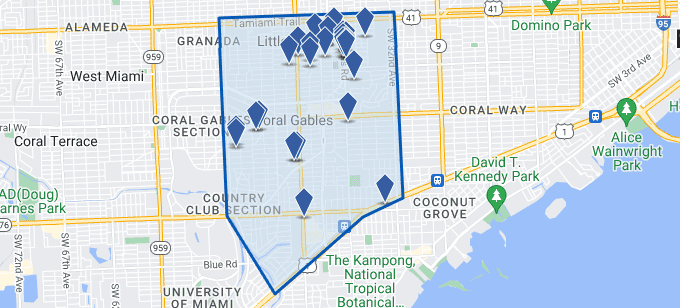

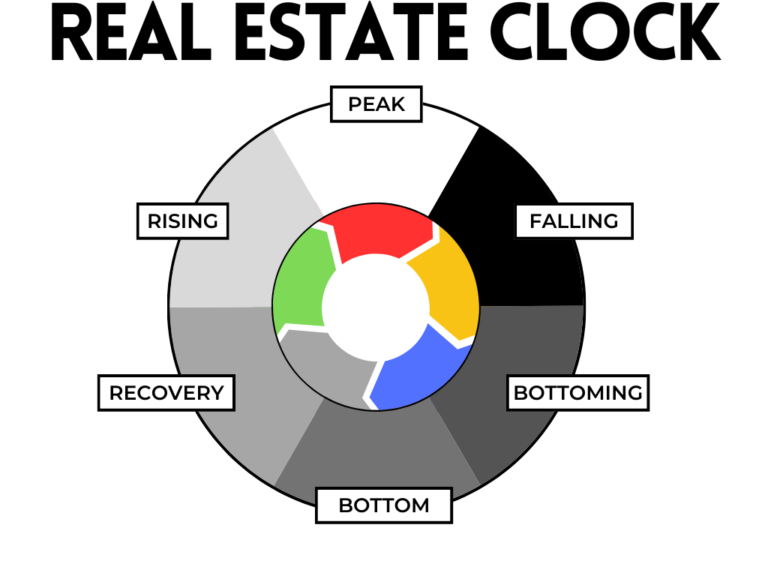

Typical real estate cycles have last 8-10 year between bottom to bust, the current cycle started around 2010 after the Great Recession and has been on a parabolic tear fueled by cheap capital and lack of supply since then (14 years and counting.)

If you have owned property since the bottom or longer, you’re maybe considering your options. When you hear that the capital gains taxes could be more than what you originally paid for the property, though, you might feel turned off by the idea.

There are advantages to paying the taxes and moving to cash, especially now with High Yield Savings account paying 5% or more. However, if you plan to continue to invest in real estate, you can delay (not completely avoid) those taxes by doing a 1031 exchange.

This is an excellent option for investors that want to trade a property that has appreciated greatly over the years but is high maintenance like an apartment building into a NNN retail property.

Understanding the Basics of a 1031 Exchange

A 1031 exchange is named after Section 1031 of the U.S. Internal Revenue Code. It allows investors to defer paying capital gains taxes when selling an investment property, provided the proceeds are reinvested in a like-kind property of equal or greater value within specific time limits. This strategy can offer significant tax advantages, freeing up more capital for reinvestment.

Key Components of a 1031 Exchange

The Role of Qualified Intermediaries

A qualified intermediary is essential in a 1031 exchange. This neutral third party holds the sale proceeds and facilitates the purchase of the replacement property, ensuring compliance with IRS regulations.

When to Consider a 1031 Exchange

Investors might pursue a 1031 exchange to diversify their portfolio, consolidate properties, switch to a managed property, or reset the depreciation clock. The primary benefit is the deferral of capital gains tax, but these exchanges often require substantial investment and professional management.

Depreciation and Its Impact

Depreciation is the annual write-off of a property’s cost due to wear and tear. When selling, the depreciation recaptured is taxable. A 1031 exchange can defer this tax liability, potentially offering significant savings.

Replacement Property Rules and Timing

To maximize benefits, the replacement property should be of equal or greater value. Investors must identify the replacement property within 45 days and complete the exchange within 180 days, adhering to specific identification rules like the three-property rule, the 200% rule, or the 95% rule.

Types of 1031 Exchanges

- Delayed Exchange: Commonly used, allows 180 days to complete the exchange.

- Build-to-Suit Exchange: Allows improvements on the replacement property within the 180-day period.

- Reverse Exchange: Acquire the replacement property before selling the original one, requiring a qualified intermediary to hold the property temporarily.

Estate Planning Benefits

A 1031 exchange can offer estate planning advantages by stepping up the basis of inherited property to its fair market value, potentially erasing deferred tax liabilities.